Every parent wonders how they can best save for their kids’ college plans, but preparing for college requires more than just saving: You have to develop goals, talk to your kids about which colleges they’re considering, and get creative in order to save. All of this can seem overwhelming, and it’s hard to know where to start. If your family is like many surveyed in Sallie Mae’s How America Pays for College 2019 report, however, you consider college an investment in your child–so Sallie Mae, a planning, savings, and paying for college-focused company, has developed four big tips to help families plan, save, and pay for college.

1. Develop a savings goal for college

It’s no secret that college can be expensive, and when your child is envisioning their dream school, chances are they aren’t thinking about the price tag. It’s a good idea to talk with them and do some initial research about the costs of four-year public and private schools, as well as local community colleges, and think about how much you can realistically save each year before your child begins school. Make sure not to set a goal so high that you have to dip into your own retirement savings in order to meet it.

If you haven’t yet set your savings goal, or you don’t know where to start, Sallie Mae’s College Planning Calculator can help you create a customized plan.

2. Look into 529 plans for your family

529 plans are a tool that helps you save for your child’s college education. You can invest early, your contributions grow tax-free, and you can withdraw from the funds when your child goes to college. A 529 plan can cover a wide variety of education-related expenses, including tuition, mandatory fees, books, computers, certain room and board costs, and even equipment that may be required for enrollment or attendance.

The minimum amount required to open an account varies, but many 529 plans require as little as $25. Some plans offer lower minimums if you enroll in direct deposit.

If your child doesn’t go to college, you can change the beneficiary to a sibling, grandchild, niece, nephew, or other relative. Even if you don’t use the funds for qualified education expenses, you may not lose the entire investment. Instead, you may pay a penalty and income tax on your earnings.

3. Get creative when it comes to saving

Smart habits help parents save more. Consider the following:

- Make regular deposits to your child’s college fund. If you can set up a direct deposit (of any dollar amount) directly from your paycheck, this will become money you’re used to not ‘seeing’ – making it easier to watch their college fund grow.

- Sit down for a budget discussion with your family members and determine where you can spend less on household and personal items. Shaving off a few dollars from an entertainment budget each month, for example, can be a gratifying way to build up your savings accounts and build toward your future.

- Do you get cash back from reward programs? This is a great way to put “free money” into college savings accounts.

- Remember: every dollar saved for college is a dollar not borrowed.

4. Both you and your kids should take scholarships seriously

Scholarships are one of the most prevalent funding sources families use to help pay for college, but the key is knowing where to find them, and how to apply.

- Many scholarships may just be for a few hundred dollars, but they can add up, and can be used for a variety of college expenses. Apply for as many as possible, and you’ll be surprised by how much you can earn.

- Apply for scholarships in your junior year of high school and every year in college. Approximately 50 percent of available scholarships are for students already enrolled in college. There are also many scholarships available for graduate school.

- Sallie Mae’s Scholarship Search is free and home to 5 million scholarships collectively worth more than $24 billion. Students fill out a brief profile, and in minutes, the tool responds with matches that identify relevant scholarships, their award amounts, application requirements, and deadlines, and the tool automatically sends updates when it identifies new matches.

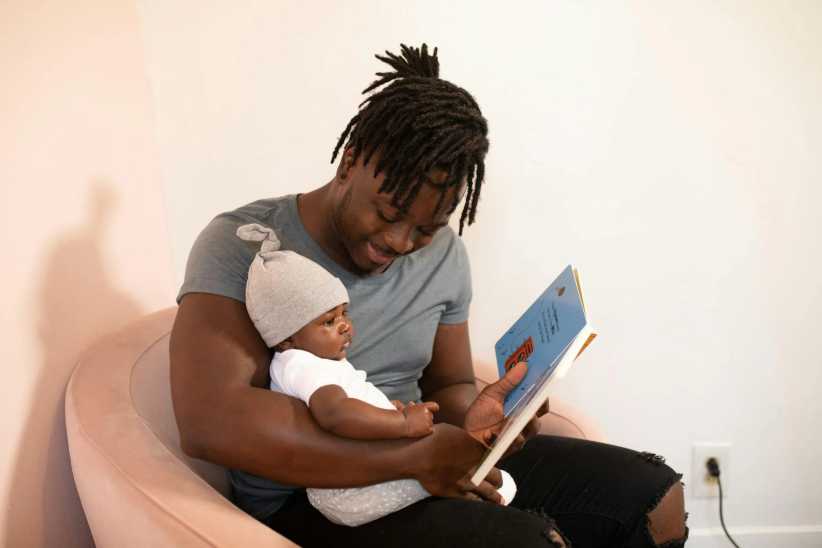

5. Make sure you have the college talk with your child

Introduce the idea of college to students at the elementary school level. Let them know what college is and what doors it can open up for them. You can even bring them to a local campus so they can imagine themselves there later on, and together, you can determine what kind of college experience would best suit your child.

Elementary school is also a good time to introduce your kids to money basics, like savings accounts, which can help them understand college costs later. To do so, keep things simple. Give your kids an allowance for doing chores around the house. If they get money for a birthday or holiday, encourage them to stash it away—maybe even for college.

Sallie Mae recommends the 1-2-3 approach to saving for college: first, open a savings account; second, set a goal and make deposits regularly; and third, explore tax-advantaged options such as 529 college savings plans. For more information about saving, planning, and paying for college, visit Sallie Mae's website.